The pictures are me at the Santa Clara Computer Museum.

Monday, September 12, 2016

Sunday, August 14, 2016

Moonshot calculations

Catching up with some reading (They promised us jet packs, New York Times Sunday, July 24, 2016). It is discussing Google’s (Alpha’s) shifting strategy regarding Moonshot VC research endeavors. Scattered about in accompanying pictures are erector sets, oscilloscopes, physical things.

Where fail fast once was the mantra it now is fail faster yet.

Head Xman Astro Teller says: “If you actually want to make the world better – then do what actually makes the world better – and the technology will take care of itself.”

Mr. teller speaks https://m.youtube.com/watch?v=2t13Rq4oc7Aat Ted

The key to technology assessment is to segment according to technology employed, vendor

And end use application. Must important may be end use application. But it is not wholly logical. For Google the end use application of the Killer Kilwauskee variety is still advertising. Which is so very based on psychology, or voodoo economics.

Where fail fast once was the mantra it now is fail faster yet.

Head Xman Astro Teller says: “If you actually want to make the world better – then do what actually makes the world better – and the technology will take care of itself.”

Mr. teller speaks https://m.youtube.com/watch?v=2t13Rq4oc7Aat Ted

The key to technology assessment is to segment according to technology employed, vendor

And end use application. Must important may be end use application. But it is not wholly logical. For Google the end use application of the Killer Kilwauskee variety is still advertising. Which is so very based on psychology, or voodoo economics.

Sunday, July 24, 2016

Notes for a future article on Mahout

Mahout is changing. Its changed over the years from recommender to core engine for the math part.. What users do is put a surface on it, and tweak the algorithms. Contrast that to using a product like Datameer. It may relatively be a black box in terms of how it does what it does. But there is some assurity that it is a path that is tested and you should have less of an adventure in implementing it. Just as you may enlist vendor field engineers in order to do the implementation, you may get to a place in your Mahout build, and opt to bring in a consultant.

Let's look http://www.slideshare.net/chrishalton/build-vs-buy-strategy at build v buy basics.

Let's look http://www.slideshare.net/chrishalton/build-vs-buy-strategy at build v buy basics.

Tuesday, July 12, 2016

Monday, July 4, 2016

Simplexity kilt the cat

Simplexity by Jeffrey Kluger (subtitled Why Simple Things Become Complex and how complex things can be made simple). The book by the then (2008) Time reporter describes a ''newly emerging Science"(Maybe si, maybe no) meant to provide a cross disciplinary view on systems ranging from ant colonies to stock market. The "SFI" San Jose Instituite is the sort of anchor source (let by Prof Gell-Mann). Along the way (p31) he speaks w Brandeis economist Blake Lebaron who has been studying simulations of stock market trading. He has seen repeating patterns: 1-Traders wobble about; 2-one finds a useful stratagem; 3-the others mimic it; 4-diminishing returns set in. THe repeating patterns I think may be relevant to the general flow of the tech bubble that many of us live within. Whether it is ASPs or Deep Learning or Hadoop - a scatter occurs in the discover stage, then, a coalescence around a mean ensues, until a new scatter occurs in a new discovery stage. Think Whac-A-Mole.

Simplexity kilt the cat

Simplexity by Jeffrey Kluger (subtitled Why Simple Things Become Complex and how complex things can be made simple). The book by the then (2008) Time reporter describes a ''newly emerging Science"(Maybe si, maybe no) meant to provide a cross disciplinary view on systems ranging from ant colonies to stock market. The "SFI" San Jose Instituite is the sort of anchor source (let by Prof Gell-Mann). Along the way (p31) he speaks w Brandeis economist Blake Lebaron who has been studying simulations of stock market trading. He has seen repeating patterns: 1-Traders wobble about; 2-one finds a useful stratagem; 3-the others mimic it; 4-diminishing returns set in. THe repeating patterns I think may be relevant to the general flow of the tech bubble that many of us live within. Whether it is ASPs or Deep Learning or Hadoop - a scatter occurs in the discover stage, then, a coalescence around a mean ensues, until a new scatter occurs in a new discovery stage. Think Whac-A-Mole.

https://www.amazon.com/Simplexity-Simple-Things-Become-https://www.amazon.com/Simplexity-Simple-Things-Become-Complex/dp/B002YNS18EComplex/dp/B002YNS18E

https://www.amazon.com/Simplexity-Simple-Things-Become-https://www.amazon.com/Simplexity-Simple-Things-Become-Complex/dp/B002YNS18EComplex/dp/B002YNS18E

Thursday, June 30, 2016

The nature of field data gathering has changed

The nature of field data gathering has changed, as mobile devices and notepad computers find wider circulation. Surveys that once went through arduous roll-up processes are now gathered and digitized quickly. Now, a new stage of innovation is underway, as back-end systems enable users to employ field data for near-real-time decision making. An example in the geographic information system (GIS) space is ESRI's Survey123 for ArcGIS, which was formally introduced at ESRI's annual user conference, held this week in San Diego. To read the rest of the story.

See also Be there when the GIS plays Hadoop

See also Be there when the GIS plays Hadoop

Tuesday, May 10, 2016

Less Moore's Law in Store

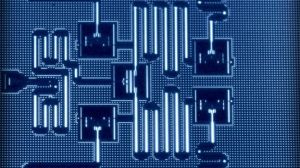

|

| Quantum computers wait in wings as Moore's Law slows to a crawl. Source: IBM |

Fair to say our sister blog turned into "The Saturday

Evening Review of John Markhoff" a long time ago. Well, at Amazing Techno Futures, the news feeds are

good - and we could do worse than to track John Markhoff, who has been covering

high tech at NYTImes for lo these many years. And I will not turn into a pumpkin if I hijack my own hijack of John.

For your consideration: His May 5 article on Moore's Law.

He rightly points out this at inception was more an observation than a law, but

Intel's Gordon Moore's 1965 eureka that the number of components that could be

etched onto the surface of a silicon wafer was doubling at regular intervals

stood the test of what today passes for time.

The news hook is a decision by the Semiconductor Industry

Assn's to discontinue its Technology Roadmap for Semiconductors, based I take

it on the closing of the Moore's Law era. IEEE will take up where this leaves

off, with a forecasting roadmap [system] that tracks a wider swath of

technology. Markhoff suggests that Intel hasn't entirely accepted the end of

this line.

Possible parts of that swath, according to Markhoff, are

quantum computing and graphene. The heat of the chips has been the major

culprit blocking Moore's Law further run. Cost may be the next bugaboo. So far,

parallelism has been the answer.

Suffice it to say, for some people at least, Moore's Law

has chugged on like a beautiful slow train of time. With the Law in effect

people at Apple, Sun, Oracle, etc. could count on things being better tomorrow

than they were today in terms of features and functionality. So the new future,

being less predictable, is a bit more foreboding.

I had my uh-ha moment on something like this in about

1983 when I was working on my master's thesis on Local Area Networks. This may

not completely be a story about Moore's Law.. But I think it has a point.

Intel was working at the time to place the better part of

the Ethernet protocol onto an Ethernet controller (in total maybe it was a

5-chip set). This would replace at least a couple of PC boards worth of

circuitry that were the only way at the time to make an Ethernet node.

I was fortunate enough to get a Mostek product engineer

on the phone to talk about the effect the chip would have on the market - in

those days it was pretty much required that there were alternative sources for

important chips, in this case Mostek. The fella described to me the volume that

was anticipated over 5 or so years, and the pricing of the chip over that time.

I transcribed his data points to a graph paper, and, as the volume went up, the

price went down. Very magical moment. - Jack Vaughan

Subscribe to:

Posts (Atom)